Top 3 Nifty 50 ETFs for Long-Term Investing in India

Welcome to this comprehensive guide on navigating the world of Exchange Traded Funds (ETFs) in India, specifically focusing on the top 3 ETFs to consider for investing in the Nifty 50. In this blog post, we will delve into the intricacies of these ETFs, how to pick the right NIFTY 50 ETF for you, and integrate it into your investment portfolio.

Understanding the Nifty 50 ETF Landscape

The Nifty 50 index represents the top 50 companies in India based on market capitalization. Investing in Nifty 50 is essentially a bet on India’s robust economic growth.

As the country flourishes, so do the top 50 companies. By investing in NIFTY 50, you’re investing in India and betting on India’s growth.

The NIFTY 50 index serves as a barometer for the economic health and growth potential of the country.

Now, let’s break down the concept of market capitalization. In simple terms, it’s the total market value of a company’s outstanding shares of stock.

The larger the company, the higher its market capitalization. Therefore, when you invest in the Nifty 50, you align your investments with India’s largest and most influential companies.

As India’s economy flourishes, propelled by factors like a burgeoning middle class and a young, productive population, the top 50 companies are poised for growth.

Nifty 50 provides a snapshot of these growth opportunities, making it an attractive choice for long-term investors.

So, why should you consider investing in an ETF tied to the Nifty 50?

The rationale is rooted in the belief that as India grows over the next decades, the top 50 companies listed in the Nifty 50 index will grow as well. It’s a long-term investment strategy that aims to capture the inherent potential of India’s economic evolution.

By placing your funds in a Nifty 50 ETF, you are creating a stress-free investment portfolio that aligns with your long-term financial goals. In the upcoming sections, we will explore the top 3 ETFs linked to the Nifty 50, providing you with the insights needed to make informed investment decisions.

Nifty 50 ETF Options in India

If I had to summarise my advice in one line, I would say You can pick any NIFTY 50 ETF if you stick with investing for the long term.

But in order to give you the specific options, I have shortlisted three different ETFs:

- Nippon NIFTY 50 ETF

- ICICI NIFTY 50 ETF

- SBI NIFTY 50 ETF

In the next section, we’ll delve into the criteria for selecting the right Nifty 50 ETF, providing a roadmap for investors to navigate the complexities and make well-informed decisions tailored to their unique financial objectives.

Criteria for Selecting the NIFTY 50 ETF

Now that I’ve given you the fish, let me teach you how I catch fish. In this section, we’ll break down the metrics and considerations that should guide your decision-making process.

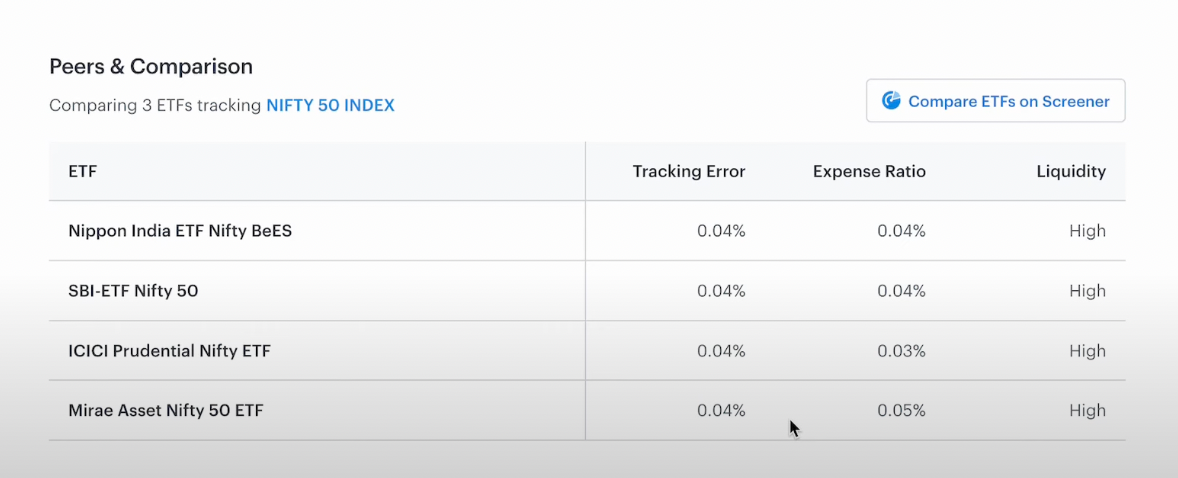

1. Expense Ratio: The expense ratio is a fundamental metric that measures the annual costs associated with managing an ETF as a percentage of its total assets.

In simpler terms, it represents the fee you pay as an investor for the fund’s management. The lower the expense ratio, the more cost-effective the investment.

While Nifty Bees and Nippon India ETF are praised for their low expense ratios, comparing this aspect across all considered ETFs is imperative.

A fractional difference can accumulate over time, significantly impacting your returns.

2. Tracking Error: Tracking error measures the deviation between the performance of an ETF and its benchmark index, in this case, the Nifty 50.

A lower tracking error indicates that the ETF closely mirrors the movements of the index. The video transcript touches on this metric, noting that tracking error can play a pivotal role in determining the effectiveness of an ETF.

A minimal tracking error implies that the fund is successfully replicating the NIFTY 50’s performance, aligning with your goal of investing in the broader market.

3. Fund House Reputationand ETF age: The fund house managing the ETF holds significance in influencing its performance and reliability.

As you assess SBI ETF and ICICI Prudential ETF, consider the reputation and track record of their respective fund houses. A reputable and experienced fund house adds a layer of confidence to your investment decision.

Here’s the full video explaining this and how I pick the right NIFTY 50 ETFs:

Portfolio Design with NIFTY 50 ETFs

Now that we’ve conducted a comprehensive comparative analysis of the top Nifty 50 ETFs, it’s time to shift our focus to the critical aspect of portfolio design.

Once you’ve picked your NIFTY 50 ETF, it’s about designing your overall investment portfolio.

For me, NIFTY 50 ETF takes up around 25% of my overall equity portfolio.

You can decide your allocation to NIFTY 50 based on your age, personal goals, investment horizon, and strategy.

Here are 3 tips that can help you add in the NIFTY 50 ETF into your portfolio easily:

1. The NIFTY 50 ETF should fall into the percentage you’ve allocated to large-cap companies. As per me, It’s a better alternative to large cap mutual funds in general.

2. You can increase the allocation to the ETF based on your risk appetite and as it changes over time.

3. You can choose to rebalance your portfolio every 6 months to keep the allocation as per your overall strategy.

The ultimate goal of this portfolio design is encapsulated in the idea that a well-constructed, diversified, and minimalistic investment portfolio allows the investor to “sleep peacefully at night.”

This sentiment underscores the importance of creating a portfolio that aligns with one’s risk tolerance, financial goals, and overall life philosophy.