Top 3 Best Index Funds in India

Investing in index funds is a popular and cost-effective way to gain exposure to the growth of the India market. This blog post explores the best index funds in India, providing insights into their features and benefits and how to choose the right ones for your investment goals.

Best Types of Index Funds in India

Nifty 50 Index Funds in India: This category tracks the Nifty 50 index, representing the 50 largest companies listed on the National Stock Exchange of India.

Nifty Next 50 Index Funds in India: This category tracks the Nifty Next 50 index, comprising the next 50 largest companies after the Nifty 50.

Mid Cap 150 Index Funds in India: This category tracks the Nifty Midcap 150 index, representing the 150 mid-cap companies listed on the NSE.

Bonus Category: US Market Index

Key Criteria When Choosing Index Funds in India

Expense Ratio: This is the annual fee charged by the fund manager. Lower expense ratios are better.

Tracking Error: This measures how closely the fund’s performance mirrors the underlying index. Smaller tracking errors are better.

Fund Age and Stability: Opt for funds with a longer track record and a reputable fund house.

Minimum Investment Amount: Some funds have minimum investment requirements.

Personal Risk Tolerance: Choose a portfolio design that aligns with your risk appetite.

Want to deep dive?

Here’s the full video on picking the best index funds in India:

My Top Picks for Each Type of Index Fund in India

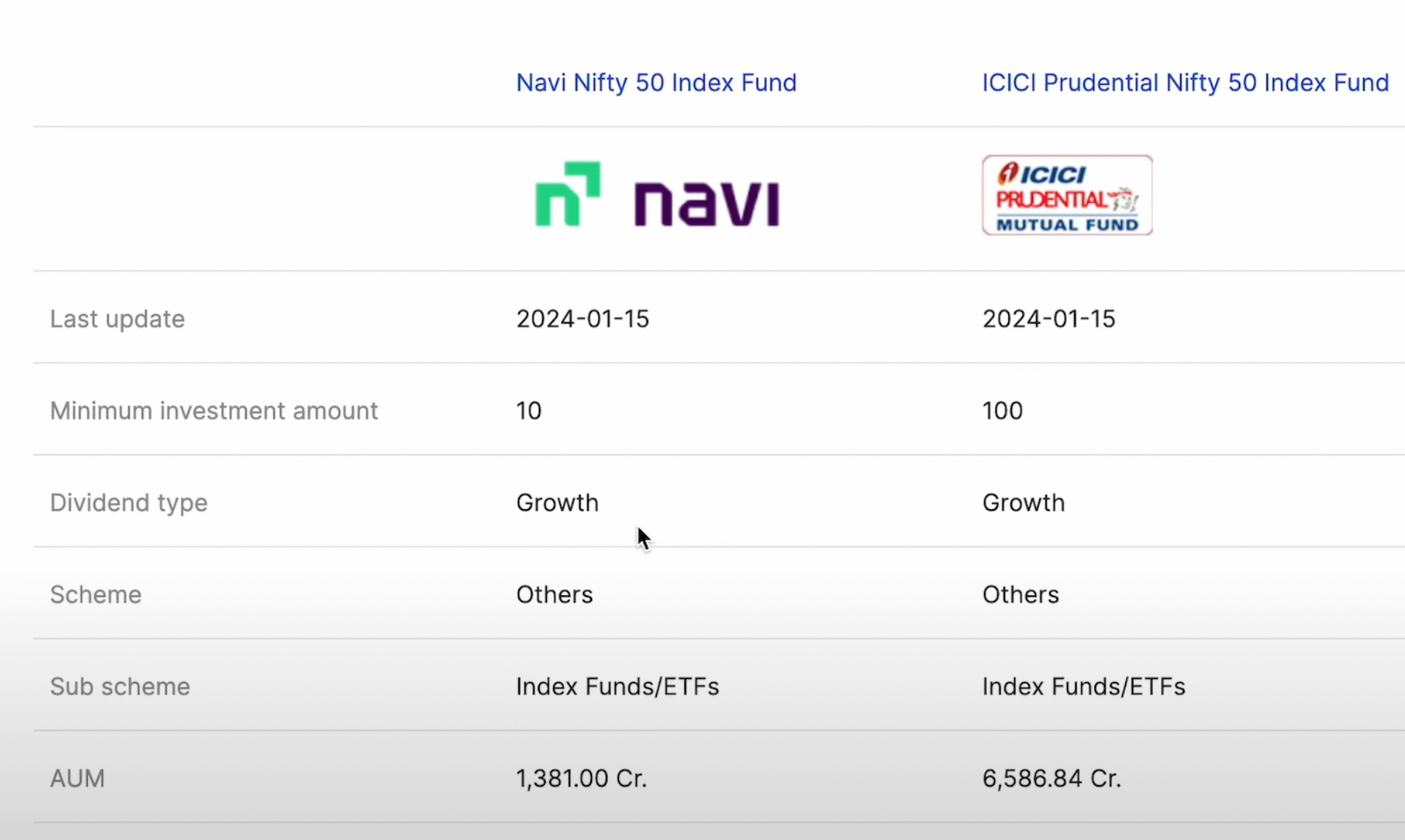

Nifty 50: Navi Nifty 50 Index Fund

Nifty Next 50: ICICI Prudential Nifty Next 50 Index Fund

Mid Cap 150: Either NAVI or ICICI Mid Cap 150 Index Fund

P.S. I am not financially driven or sponsored by either of these funds.

Bonus Category: US Market:

For some diversification, you can choose Navi U.S. Equity Index Fund, Motilal Oswal Nasdaq 100, ICICI Prudential US Nasdaq 100 Index Fund, or Motilal Oswal S&P 500 Index Fund.

Designing your Portfolio with Index Funds in India

Here are some scenarios though the exact portfolio will be based on your needs and your own research:

- Portfolio 1 (Conservative): 50% Nifty 50, 30% Next 50, 20% Mid Cap 150

- Portfolio 2 (Balanced): 40% Nifty 50, 20% Next 50, 20% Mid Cap 150, 10% US Market

- Portfolio 3 (Aggressive): 20% Nifty 50, 30% Next 50, 50% Mid Cap 150

Here are the details on what each portfolio is good for:

Portfolio 1: The Cautious Navigator (50% Nifty 50 Index Fund , 30% Next 50 Index Fund, 20% Mid Cap 150 Index Fund)

This portfolio prioritizes stability and capital preservation, making it ideal for risk-averse investors or those nearing retirement.

- 50% Nifty 50: The anchor of the portfolio, offering exposure to well-established companies with proven track records. Their lower volatility provides a buffer against market fluctuations.

- 30% Nifty Next 50: Introduces a measured tilt towards growth by incorporating promising mid-cap companies with the potential to graduate into the Nifty 50 in the future.

- 20% Mid Cap 150: A calculated foray into the mid-cap space, offering the potential for higher returns but also carrying greater risk due to the inherent volatility of smaller companies.

Portfolio 2: The Balanced Explorer (40% Nifty 50, 20% Next 50, 20% Mid Cap 150, 10% US Market)

This portfolio strikes a balance between stability and growth, catering to investors with a moderate risk tolerance.

- 40% Nifty 50: Maintains a significant allocation to large-cap stability, providing a solid foundation for the portfolio.

- 20% Next 50: Similar to Portfolio 1, it allocates a portion to promising mid-cap companies for measured growth potential.

- 20% Mid Cap 150: Maintains the mid-cap exposure for potentially higher returns while keeping it within a controlled range.

- 10% US Market: Introduces a diversification element by incorporating exposure to the US market through an index fund. This helps mitigate risks associated with relying solely on the Indian market.

Portfolio 3: The Growth Adventurer (20% Nifty 50, 30% Next 50, 50% Mid Cap 150)

This portfolio prioritizes growth potential over stability, targeting investors with a high-risk tolerance and a long-term investment horizon.

- 20% Nifty 50: Retains a minimal allocation to large-caps for some stability, but significantly reduces it compared to the other portfolios.

- 30% Next 50: Increases the exposure to mid-cap companies with higher growth potential, aiming to capture their promising trajectories.

- 50% Mid Cap 150: Dives deep into the mid-cap space, seeking significant returns but acknowledging the inherent volatility associated with smaller companies.

Additional Tips:

- Consider actively managed small-cap mutual funds for additional diversification, but conduct thorough research before investing.

- Regularly review and rebalance your portfolio to maintain your desired asset allocation.

- Remember that index funds are for long-term investment and may experience volatility in the short term.